Global Industrial Automation

Market outlook

1. Industrial Software – rising adoption and increasing product complexity (all the way to mass-customisation) supports high single-digit growth outlook and we agree with Siemens’ 7% CAGR estimate. Software crosspollination of hardware is also becoming increasingly transparent.

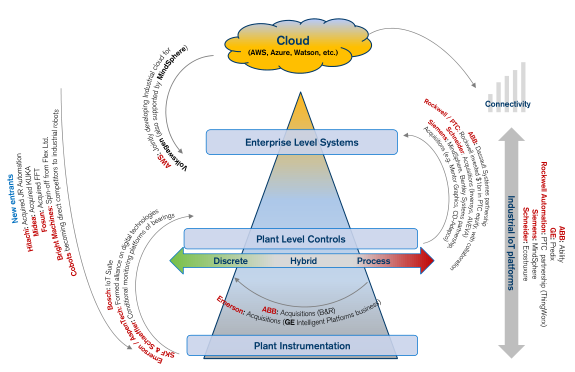

2. Industrial IoT Platforms – the arms race continues with now >500 offerings by traditional automation, software and tech players, but also evidence of consolidation (GE Predix, Rockwell FactoryTalk) and leadership emerging (AWS, Microsoft, Siemens MindSphere); closing the machine-to-machine loop is the ultimate goal.

3. Discrete Automation – cycle debate aside, we see re-shoring and generally rising adoption as positives but have concerns over 1) automotive shift to EVs where drivetrain BOM is ¼ of ICE’s and 2) increasing efforts in PLC virtualization (unlikely for auto, in our view, but possible for new applications).

4. Process Automation – as most mature segment, we expect growth closer to General IP (c3-4% pa).

5. Robotics – auto capex cycle headwind near term but overall rising adoption remains a structural driver; market shift towards cobots to watch.

Potential strategic moves

1. acquisitions of independent industrial software players;

2. acquisitions of system integrators by lateral entrants to gain customer proximity;

3. IIoT platforms consolidation;

4. cloud and analytics vendors to compete with IIoT platforms;

5. traditional robot makers acquiring into cobots.

Industrial Automation – “Hardware x Software” Crossover

版权声明、联系方式、沪ICP备18044866号-1 |